All Categories

Featured

Table of Contents

For many individuals, the greatest issue with the boundless banking concept is that initial hit to early liquidity brought on by the costs. Although this con of unlimited financial can be decreased significantly with proper policy style, the first years will constantly be the worst years with any kind of Whole Life policy.

That said, there are certain limitless financial life insurance policies created mostly for high early cash value (HECV) of over 90% in the very first year. The long-term performance will certainly typically substantially lag the best-performing Infinite Banking life insurance coverage plans. Having accessibility to that extra four figures in the very first few years may come with the cost of 6-figures down the road.

You actually get some considerable lasting benefits that help you recover these very early expenses and afterwards some. We locate that this prevented early liquidity issue with unlimited banking is extra psychological than anything else when completely explored. If they definitely required every penny of the cash missing from their unlimited financial life insurance coverage plan in the very first couple of years.

Tag: boundless financial principle In this episode, I chat regarding finances with Mary Jo Irmen that educates the Infinite Banking Idea. With the increase of TikTok as an information-sharing platform, monetary recommendations and methods have located an unique means of spreading. One such technique that has actually been making the rounds is the unlimited financial idea, or IBC for brief, amassing endorsements from celebs like rapper Waka Flocka Fire.

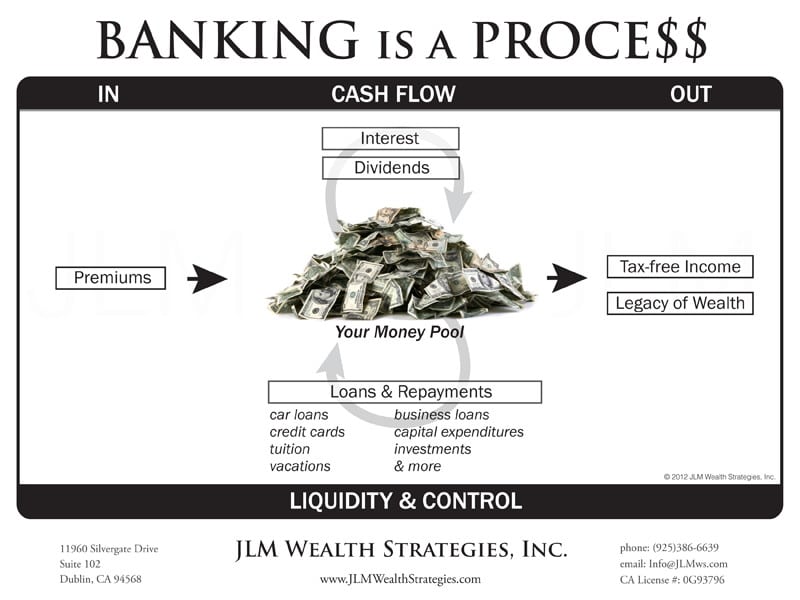

Within these plans, the money worth grows based upon a price established by the insurer. When a significant cash money value gathers, insurance policy holders can obtain a money worth car loan. These car loans differ from traditional ones, with life insurance functioning as security, suggesting one might shed their protection if borrowing exceedingly without appropriate money worth to sustain the insurance coverage prices.

And while the attraction of these policies appears, there are natural limitations and threats, demanding attentive cash worth tracking. The technique's authenticity isn't black and white. For high-net-worth people or business owners, particularly those making use of strategies like company-owned life insurance coverage (COLI), the benefits of tax obligation breaks and substance development could be appealing.

Bank Infinity

The appeal of infinite banking doesn't negate its difficulties: Cost: The foundational demand, a permanent life insurance policy, is more expensive than its term counterparts. Qualification: Not everybody qualifies for entire life insurance due to rigorous underwriting processes that can omit those with specific wellness or way of living problems. Intricacy and danger: The detailed nature of IBC, coupled with its risks, might discourage numerous, particularly when less complex and less dangerous alternatives are readily available.

Designating around 10% of your monthly earnings to the policy is simply not practical for lots of people. Utilizing life insurance policy as an investment and liquidity resource requires self-control and surveillance of plan money worth. Get in touch with a monetary expert to establish if infinite financial straightens with your concerns. Component of what you review below is merely a reiteration of what has already been claimed over.

So prior to you obtain into a situation you're not planned for, recognize the complying with initially: Although the concept is commonly sold therefore, you're not in fact taking a car loan from yourself. If that held true, you wouldn't have to repay it. Rather, you're borrowing from the insurance provider and have to settle it with rate of interest.

Some social media posts advise making use of money value from entire life insurance coverage to pay down credit score card financial debt. When you pay back the funding, a portion of that interest goes to the insurance firm.

For the very first several years, you'll be repaying the compensation. This makes it extremely hard for your policy to accumulate worth throughout this time around. Entire life insurance policy expenses 5 to 15 times a lot more than term insurance coverage. The majority of people merely can't manage it. Unless you can afford to pay a few to numerous hundred bucks for the following decade or even more, IBC won't work for you.

Infinite Banking Insurance Policy

Not everybody must count entirely on themselves for monetary security. If you call for life insurance policy, below are some useful ideas to take into consideration: Take into consideration term life insurance policy. These policies provide insurance coverage during years with significant economic obligations, like home loans, pupil financings, or when caring for young youngsters. Ensure to shop around for the finest price.

Copyright (c) 2023, Intercom, Inc. () with Reserved Font Call "Montserrat". This Font Software application is licensed under the SIL Open Up Typeface Certificate, Variation 1.1. Copyright (c) 2023, Intercom, Inc. (legal@intercom.io) with Scheduled Typeface Call "Montserrat". This Font Software is licensed under the SIL Open Typeface Permit, Version 1.1.Avoid to primary web content

What Is Infinite Banking Concept

As a CPA concentrating on actual estate investing, I have actually brushed shoulders with the "Infinite Banking Concept" (IBC) extra times than I can count. I've even spoken with experts on the subject. The major draw, apart from the evident life insurance policy benefits, was always the idea of developing up cash worth within a long-term life insurance policy plan and loaning against it.

Sure, that makes good sense. However truthfully, I constantly believed that cash would certainly be much better invested straight on financial investments instead than channeling it via a life insurance policy Till I uncovered how IBC could be combined with an Irrevocable Life Insurance Policy Trust Fund (ILIT) to produce generational wealth. Let's begin with the basics.

Can You Be Your Own Bank

When you borrow versus your plan's cash money value, there's no collection payment routine, providing you the flexibility to handle the financing on your terms. At the same time, the cash money value continues to grow based upon the plan's guarantees and dividends. This arrangement enables you to accessibility liquidity without interrupting the long-term growth of your policy, gave that the financing and passion are taken care of wisely.

The process continues with future generations. As grandchildren are born and grow up, the ILIT can purchase life insurance policy plans on their lives also. The trust fund then collects numerous plans, each with expanding cash money values and survivor benefit. With these plans in position, the ILIT effectively ends up being a "Household Financial institution." Family members can take fundings from the ILIT, utilizing the cash money worth of the policies to money financial investments, start businesses, or cover major expenditures.

A vital aspect of managing this Family Financial institution is making use of the HEMS criterion, which stands for "Wellness, Education And Learning, Maintenance, or Support." This standard is often included in trust fund agreements to route the trustee on exactly how they can distribute funds to recipients. By adhering to the HEMS requirement, the trust fund makes certain that circulations are made for crucial requirements and long-term support, securing the trust's assets while still offering relative.

Enhanced Versatility: Unlike rigid financial institution car loans, you manage the payment terms when obtaining from your own plan. This enables you to structure repayments in a method that aligns with your service money circulation. infinite banking toolkit. Improved Cash Money Flow: By funding company expenses with plan loans, you can possibly maximize cash money that would certainly otherwise be linked up in typical financing payments or devices leases

He has the very same devices, however has actually likewise developed added money worth in his plan and got tax benefits. And also, he now has $50,000 available in his plan to use for future possibilities or expenses. Regardless of its potential advantages, some people remain skeptical of the Infinite Banking Idea. Allow's attend to a few usual worries: "Isn't this simply costly life insurance policy?" While it's real that the costs for an effectively structured whole life plan may be greater than term insurance, it is necessary to watch it as greater than just life insurance policy.

Rbc Visa Infinite Private Banking Card

It has to do with developing a versatile financing system that provides you control and gives numerous advantages. When used purposefully, it can match other financial investments and organization techniques. If you're fascinated by the possibility of the Infinite Financial Principle for your organization, here are some actions to consider: Educate Yourself: Dive deeper into the idea with credible books, seminars, or consultations with experienced professionals.

Latest Posts

Infinite Bank Concept

Paradigm Life Infinite Banking

Nelson Nash Reviews