All Categories

Featured

Table of Contents

The are whole life insurance and universal life insurance policy. expands cash worth at an assured rate of interest and likewise with non-guaranteed returns. expands cash money value at a repaired or variable price, depending on the insurer and policy terms. The cash worth is not contributed to the death benefit. Cash money value is a function you make the most of while to life.

After one decade, the cash money value has expanded to about $150,000. He gets a tax-free lending of $50,000 to begin a service with his sibling. The policy financing rate of interest is 6%. He pays off the financing over the next 5 years. Going this route, the passion he pays goes back right into his plan's cash money value rather than a monetary institution.

Cash Flow Banking Reviews

Nash was a financing specialist and follower of the Austrian school of economics, which promotes that the worth of products aren't clearly the result of conventional economic structures like supply and demand. Rather, people value money and items in different ways based on their economic standing and needs.

One of the risks of typical financial, according to Nash, was high-interest prices on finances. Long as financial institutions established the rate of interest rates and lending terms, people really did not have control over their own wide range.

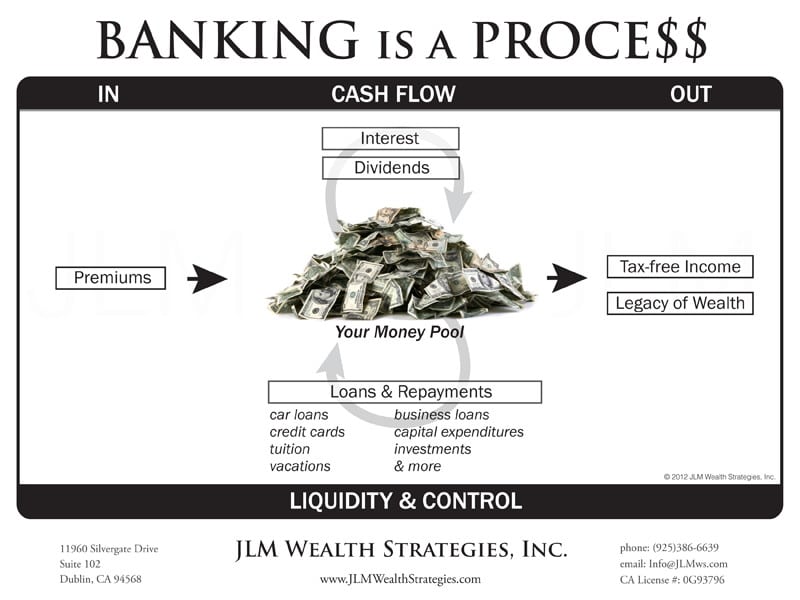

Infinite Financial needs you to have your financial future. For ambitious individuals, it can be the best financial tool ever. Here are the benefits of Infinite Financial: Probably the solitary most helpful element of Infinite Banking is that it improves your money circulation. You don't require to undergo the hoops of a standard bank to get a lending; just demand a policy financing from your life insurance business and funds will be offered to you.

Dividend-paying entire life insurance is very low risk and uses you, the insurance policy holder, an excellent deal of control. The control that Infinite Financial supplies can best be organized right into two classifications: tax obligation benefits and property protections.

The Infinite Banking Concept

When you make use of entire life insurance coverage for Infinite Banking, you participate in a private contract between you and your insurance policy business. This privacy offers certain possession securities not located in various other financial vehicles. These protections might differ from state to state, they can consist of protection from property searches and seizures, protection from judgements and protection from financial institutions.

Entire life insurance policies are non-correlated possessions. This is why they function so well as the financial foundation of Infinite Financial. No matter of what takes place in the market (supply, realty, or otherwise), your insurance coverage preserves its worth. A lot of individuals are missing out on this vital volatility barrier that aids protect and grow riches, instead breaking their money right into two buckets: bank accounts and financial investments.

Entire life insurance policy is that third pail. Not just is the price of return on your entire life insurance coverage plan ensured, your fatality advantage and costs are additionally assured.

Below are its main benefits: Liquidity and availability: Plan lendings supply prompt access to funds without the constraints of standard bank financings. Tax obligation efficiency: The cash value expands tax-deferred, and plan finances are tax-free, making it a tax-efficient tool for building wealth.

Infinite Banking Review

Possession security: In lots of states, the cash money value of life insurance policy is secured from lenders, adding an additional layer of financial protection. While Infinite Banking has its values, it isn't a one-size-fits-all solution, and it includes considerable drawbacks. Right here's why it might not be the most effective technique: Infinite Banking frequently calls for intricate plan structuring, which can perplex policyholders.

Imagine never having to fret about financial institution fundings or high passion prices once more. That's the power of unlimited banking life insurance coverage.

There's no set car loan term, and you have the liberty to select the payment routine, which can be as leisurely as repaying the finance at the time of death. This adaptability includes the maintenance of the loans, where you can select interest-only payments, maintaining the finance balance flat and convenient.

Holding money in an IUL repaired account being credited passion can commonly be much better than holding the cash on deposit at a bank.: You've always dreamed of opening your very own bakery. You can obtain from your IUL policy to cover the first expenses of renting a space, buying devices, and employing staff.

Banking Concept

Individual lendings can be obtained from typical financial institutions and credit unions. Borrowing cash on a credit card is generally really expensive with yearly portion prices of rate of interest (APR) commonly getting to 20% to 30% or even more a year.

The tax therapy of policy financings can differ dramatically depending on your country of house and the certain regards to your IUL policy. In some areas, such as The United States and Canada, the United Arab Emirates, and Saudi Arabia, policy car loans are normally tax-free, supplying a substantial advantage. Nonetheless, in other territories, there may be tax obligation implications to consider, such as potential taxes on the lending.

Term life insurance coverage only offers a survivor benefit, with no cash worth build-up. This suggests there's no cash worth to obtain against. This short article is authored by Carlton Crabbe, President of Resources forever, a specialist in giving indexed global life insurance policy accounts. The details supplied in this post is for instructional and educational purposes only and must not be construed as economic or investment guidance.

For financing officers, the substantial policies imposed by the CFPB can be seen as cumbersome and limiting. Funding police officers often suggest that the CFPB's guidelines create unnecessary red tape, leading to more documents and slower lending handling. Rules like the TILA-RESPA Integrated Disclosure (TRID) policy and the Ability-to-Repay (ATR) needs, while targeted at safeguarding customers, can lead to hold-ups in closing deals and enhanced operational prices.

Latest Posts

Infinite Bank Concept

Paradigm Life Infinite Banking

Nelson Nash Reviews