All Categories

Featured

Table of Contents

Of program, there are other benefits to any entire life insurance coverage policy. While you are attempting to reduce the ratio of premium to death advantage, you can not have a plan with absolutely no death advantage.

Some individuals offering these plans argue that you are not interrupting compound rate of interest if you borrow from your policy instead than take out from your financial institution account. The money you obtain out makes absolutely nothing (at bestif you do not have a wash car loan, it may even be costing you).

A great deal of the individuals that buy right into this idea likewise get into conspiracy theory concepts concerning the globe, its federal governments, and its banking system. IB/BOY/LEAP is positioned as a method to somehow prevent the globe's monetary system as if the world's biggest insurance policy firms were not component of its economic system.

It is invested in the general fund of the insurance policy company, which mainly buys bonds such as US treasury bonds. No magic. No revolution. You get a bit greater passion price on your cash (after the initial couple of years) and possibly some possession defense. That's it. Like your investments, your life insurance coverage should be monotonous.

Cut Bank Schools Infinite Campus

It feels like the name of this idea modifications when a month. You might have heard it described as a continuous wealth approach, family banking, or circle of riches. Whatever name it's called, infinite banking is pitched as a secret means to build riches that only rich individuals find out about.

You, the insurance holder, placed cash right into an entire life insurance policy with paying premiums and purchasing paid-up additions. This increases the cash money worth of the policy, which indicates there is more cash for the returns price to be related to, which normally means a greater rate of return generally. Reward rates at major service providers are presently around 5% to 6%.

Td Bank Visa Infinite

The entire principle of "banking on yourself" only works due to the fact that you can "bank" on yourself by taking loans from the policy (the arrowhead in the chart over going from entire life insurance back to the policyholder). There are 2 different types of fundings the insurer might supply, either direct recognition or non-direct recognition.

One feature called "wash car loans" establishes the rate of interest on lendings to the same rate as the returns rate. This suggests you can borrow from the policy without paying interest or obtaining interest on the amount you borrow. The draw of infinite financial is a reward passion rate and guaranteed minimal rate of return.

The downsides of boundless banking are commonly neglected or otherwise stated at all (much of the information readily available concerning this idea is from insurance agents, which may be a little biased). Only the money worth is expanding at the returns price. You also need to pay for the expense of insurance, costs, and expenditures.

Business that use non-direct recognition financings may have a reduced dividend rate. Your cash is secured right into a complex insurance item, and abandonment fees normally don't disappear up until you've had the plan for 10 to 15 years. Every permanent life insurance policy policy is various, yet it's clear a person's general return on every buck spent on an insurance policy item might not be anywhere near to the dividend rate for the policy.

Be Your Own Bank Whole Life Insurance

To give a very basic and theoretical instance, allow's think someone has the ability to gain 3%, on average, for each dollar they spend on an "boundless banking" insurance policy item (besides expenses and costs). This is double the approximated return of entire life insurance coverage from Consumer Reports of 1.5%. If we assume those bucks would certainly go through 50% in tax obligations amount to if not in the insurance coverage product, the tax-adjusted rate of return might be 4.5%.

We assume higher than ordinary returns on the whole life product and a really high tax rate on dollars not put right into the policy (which makes the insurance policy product look much better). The fact for many individuals may be even worse. This pales in comparison to the long-term return of the S&P 500 of over 10%.

How To Use Life Insurance As A Bank

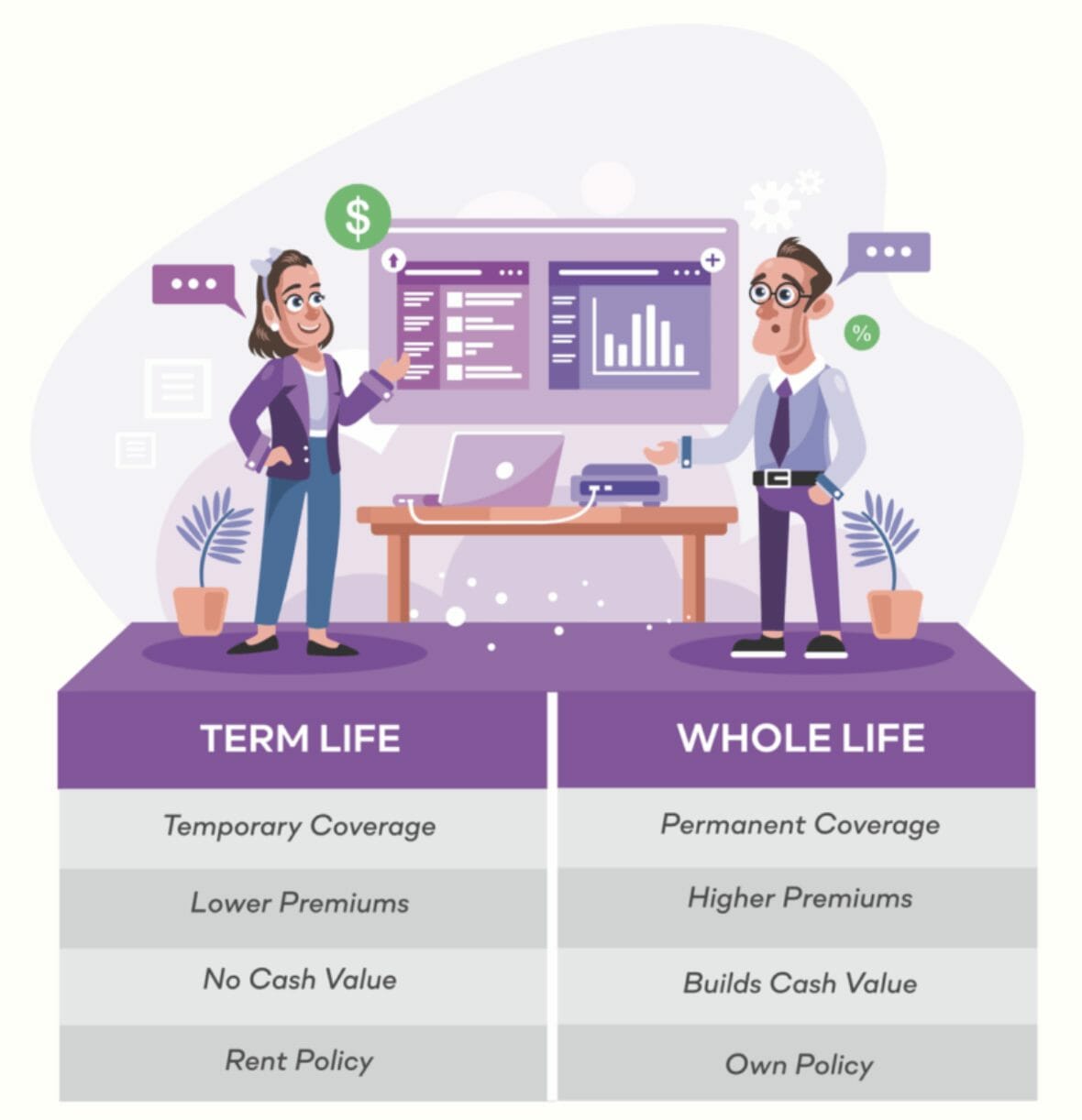

At the end of the day you are getting an insurance policy item. We enjoy the security that insurance policy uses, which can be acquired a lot less expensively from a low-priced term life insurance policy plan. Overdue car loans from the policy might likewise lower your death advantage, reducing one more level of defense in the policy.

The concept only works when you not only pay the significant premiums, however utilize extra money to buy paid-up additions. The opportunity cost of every one of those bucks is remarkable incredibly so when you can instead be investing in a Roth Individual Retirement Account, HSA, or 401(k). Even when contrasted to a taxed financial investment account and even an interest-bearing account, limitless financial may not use comparable returns (compared to investing) and comparable liquidity, accessibility, and low/no fee structure (compared to a high-yield savings account).

When it involves economic preparation, whole life insurance coverage often attracts attention as a preferred option. There's been an expanding pattern of marketing it as a tool for "boundless banking." If you have actually been exploring whole life insurance policy or have actually discovered this idea, you could have been informed that it can be a way to "become your very own financial institution." While the idea may sound enticing, it's vital to dig deeper to comprehend what this actually indicates and why seeing whole life insurance coverage this way can be deceptive.

The concept of "being your very own financial institution" is appealing since it suggests a high level of control over your funds. This control can be imaginary. Insurance companies have the best say in exactly how your policy is handled, including the regards to the financings and the rates of return on your cash value.

If you're taking into consideration entire life insurance, it's important to view it in a wider context. Whole life insurance policy can be a valuable device for estate preparation, offering an ensured survivor benefit to your beneficiaries and possibly offering tax obligation advantages. It can likewise be a forced cost savings automobile for those who have a hard time to conserve money consistently.

Be Your Own Banker Life Insurance

It's a kind of insurance coverage with a cost savings component. While it can use constant, low-risk development of cash money value, the returns are usually less than what you could achieve through other investment cars. Prior to leaping into entire life insurance policy with the idea of limitless financial in mind, put in the time to consider your financial goals, risk resistance, and the complete variety of monetary items offered to you.

Limitless banking is not a monetary cure all. While it can function in certain scenarios, it's not without dangers, and it needs a substantial dedication and understanding to take care of properly. By recognizing the possible mistakes and comprehending truth nature of entire life insurance policy, you'll be better outfitted to make an educated decision that supports your monetary health.

This book will certainly show you exactly how to establish a banking policy and exactly how to make use of the financial policy to spend in property.

Boundless financial is not a product and services offered by a details institution. Infinite financial is a strategy in which you purchase a life insurance policy plan that gathers interest-earning cash value and obtain car loans versus it, "obtaining from yourself" as a resource of resources. Then at some point repay the funding and begin the cycle all over again.

Pay plan premiums, a part of which develops money value. Take a lending out against the policy's money worth, tax-free. If you utilize this principle as intended, you're taking money out of your life insurance policy to purchase everything you would certainly require for the rest of your life.

Latest Posts

Infinite Bank Concept

Paradigm Life Infinite Banking

Nelson Nash Reviews