All Categories

Featured

Table of Contents

For most individuals, the most significant problem with the unlimited banking idea is that initial hit to early liquidity triggered by the expenses. This con of unlimited financial can be lessened considerably with correct plan design, the very first years will constantly be the worst years with any type of Whole Life plan.

That stated, there are certain unlimited financial life insurance policy policies developed largely for high very early money worth (HECV) of over 90% in the initial year. The long-term efficiency will frequently substantially lag the best-performing Infinite Financial life insurance policies. Having accessibility to that extra four numbers in the initial few years might come at the price of 6-figures in the future.

You in fact get some substantial lasting benefits that aid you recover these early expenses and after that some. We locate that this hindered very early liquidity problem with boundless banking is a lot more psychological than anything else once thoroughly discovered. If they absolutely needed every dime of the money missing from their infinite banking life insurance plan in the first few years.

Tag: infinite banking concept In this episode, I talk about funds with Mary Jo Irmen who teaches the Infinite Banking Principle. This subject might be debatable, yet I desire to obtain diverse sights on the program and learn more about different methods for ranch monetary management. Some of you might concur and others will not, yet Mary Jo brings a truly... With the rise of TikTok as an information-sharing system, monetary advice and techniques have actually located a novel way of dispersing. One such approach that has actually been making the rounds is the unlimited financial concept, or IBC for short, gathering endorsements from celebs like rap artist Waka Flocka Fire. While the approach is currently preferred, its origins map back to the 1980s when economist Nelson Nash presented it to the globe.

Within these policies, the cash value grows based upon a rate set by the insurance firm. When a significant money worth gathers, insurance policy holders can obtain a cash value loan. These financings differ from traditional ones, with life insurance policy functioning as collateral, implying one could shed their protection if loaning excessively without adequate money value to support the insurance coverage expenses.

And while the attraction of these plans appears, there are inherent constraints and risks, requiring thorough money worth surveillance. The method's authenticity isn't black and white. For high-net-worth people or entrepreneur, specifically those using techniques like company-owned life insurance policy (COLI), the benefits of tax breaks and compound development can be appealing.

Uob Privilege Banking Visa Infinite

The allure of boundless financial doesn't negate its difficulties: Cost: The fundamental requirement, an irreversible life insurance coverage policy, is pricier than its term equivalents. Eligibility: Not everyone gets approved for whole life insurance policy due to extensive underwriting processes that can leave out those with particular wellness or way of living problems. Intricacy and danger: The elaborate nature of IBC, combined with its dangers, might prevent lots of, specifically when easier and much less risky choices are available.

Assigning around 10% of your month-to-month income to the policy is simply not feasible for many people. Making use of life insurance policy as a financial investment and liquidity resource calls for discipline and surveillance of plan cash worth. Get in touch with a financial expert to establish if boundless financial straightens with your concerns. Component of what you read below is just a reiteration of what has already been said above.

So prior to you get yourself right into a scenario you're not planned for, understand the following initially: Although the idea is generally offered because of this, you're not really taking a finance from yourself. If that held true, you wouldn't have to repay it. Instead, you're borrowing from the insurance provider and have to repay it with interest.

Some social media messages suggest utilizing cash value from whole life insurance policy to pay down credit score card financial obligation. When you pay back the loan, a part of that interest goes to the insurance policy business.

For the first several years, you'll be paying off the compensation. This makes it exceptionally hard for your plan to collect worth during this time. Unless you can afford to pay a few to numerous hundred dollars for the next decade or more, IBC won't function for you.

How To Be My Own Bank

Not everybody should depend entirely on themselves for monetary protection. If you require life insurance policy, here are some beneficial pointers to take into consideration: Consider term life insurance. These policies offer insurance coverage throughout years with significant monetary responsibilities, like mortgages, student financings, or when caring for young youngsters. Ensure to go shopping about for the best price.

Copyright (c) 2023, Intercom, Inc. () with Booked Font Call "Montserrat". Copyright (c) 2023, Intercom, Inc. (legal@intercom.io) with Scheduled Typeface Name "Montserrat".

Royal Bank Infinite Avion Travel Rewards

As a CPA focusing on realty investing, I have actually combed shoulders with the "Infinite Financial Idea" (IBC) extra times than I can count. I've also spoken with professionals on the subject. The primary draw, aside from the evident life insurance coverage advantages, was constantly the idea of developing cash worth within a long-term life insurance plan and borrowing against it.

Sure, that makes feeling. Honestly, I constantly thought that money would be better invested straight on investments instead than channeling it via a life insurance plan Up until I uncovered how IBC might be incorporated with an Irrevocable Life Insurance Policy Trust (ILIT) to produce generational wealth. Let's begin with the basics.

Bank Of China Visa Infinite Card

When you obtain versus your policy's cash money worth, there's no collection repayment routine, providing you the liberty to handle the finance on your terms. The money worth proceeds to grow based on the policy's assurances and dividends. This arrangement enables you to gain access to liquidity without interrupting the long-lasting development of your policy, gave that the car loan and rate of interest are managed wisely.

As grandchildren are born and grow up, the ILIT can acquire life insurance policy plans on their lives. Family participants can take lendings from the ILIT, using the cash worth of the plans to fund financial investments, begin services, or cover major expenses.

A vital element of handling this Household Financial institution is the usage of the HEMS criterion, which means "Wellness, Education And Learning, Upkeep, or Support." This standard is usually included in trust fund arrangements to guide the trustee on how they can distribute funds to recipients. By adhering to the HEMS standard, the count on makes certain that circulations are produced crucial requirements and long-lasting support, guarding the count on's properties while still offering member of the family.

Raised Flexibility: Unlike inflexible financial institution financings, you regulate the repayment terms when borrowing from your own plan. This enables you to structure payments in a manner that lines up with your organization cash flow. infinitebanking.org. Enhanced Cash Money Flow: By funding company expenses through policy lendings, you can potentially liberate cash money that would otherwise be locked up in standard lending payments or equipment leases

He has the very same devices, however has actually additionally developed additional money worth in his policy and obtained tax benefits. Plus, he currently has $50,000 readily available in his policy to use for future opportunities or costs. Despite its possible advantages, some people continue to be doubtful of the Infinite Banking Principle. Allow's address a few common issues: "Isn't this simply costly life insurance policy?" While it holds true that the costs for an appropriately structured whole life policy may be greater than term insurance coverage, it is essential to view it as greater than simply life insurance policy.

Bank Of China Visa Infinite

It has to do with producing a flexible funding system that gives you control and offers several benefits. When made use of tactically, it can complement various other investments and service approaches. If you're intrigued by the possibility of the Infinite Banking Concept for your business, here are some steps to take into consideration: Inform Yourself: Dive much deeper right into the concept with respectable books, seminars, or examinations with well-informed professionals.

Table of Contents

Latest Posts

Infinite Bank Concept

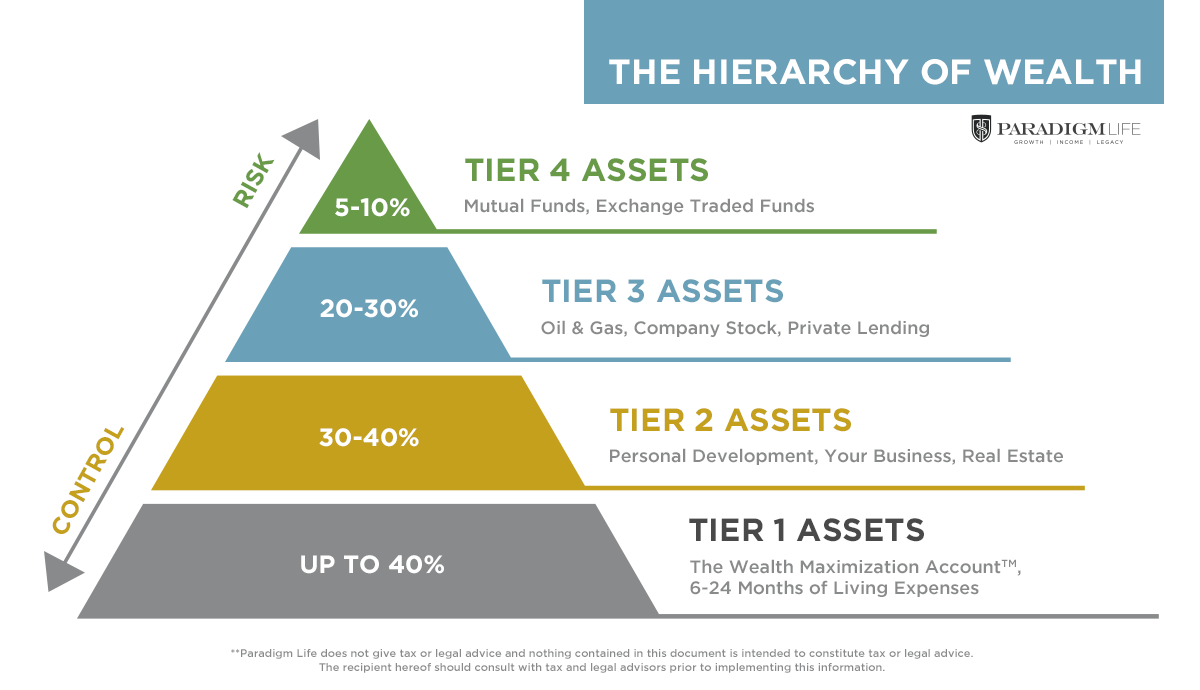

Paradigm Life Infinite Banking

Nelson Nash Reviews

More

Latest Posts

Infinite Bank Concept

Paradigm Life Infinite Banking

Nelson Nash Reviews